While the Massachusetts’ Paid Family Medical Leave (PFML) does not officially go into effect until January 1, 2021, employers must notify employees by September 30, 2019 and begin deducting withholdings as of October 1, 2019. Unlike the Federal Family Medical Leave Act, PFML applies to all employers and may also include independent contractors.

PFML offers covered individuals up to 12 weeks of paid family leave (including for the birth/adoption and care for a family member with a serious health condition), up to 26 weeks of paid leave to care for a service member injured in the line of duty, and up to 20 weeks of paid medical leave for an individual’s own serious health condition. Covered individuals are entitled to an aggregate 26 weeks of paid medical and family leave annually.

By September 30, 2019, and thereafter within 30 days of an employee’s hire, all Massachusetts employers are required to notify employees in writing of the benefits, protections, and contribution amounts under PFML by displaying a workplace poster and providing employees and qualifying contractors with separate notice depending on the number of the covered individuals. Employers are required to obtain each employee and contractor’s acknowledgment of their receipt of the notice. If an employer provided notice prior to the June 14, 2019 delay announcement, it needs to provide employees with an addendum sheet laying out the updated dates and contribution rates.

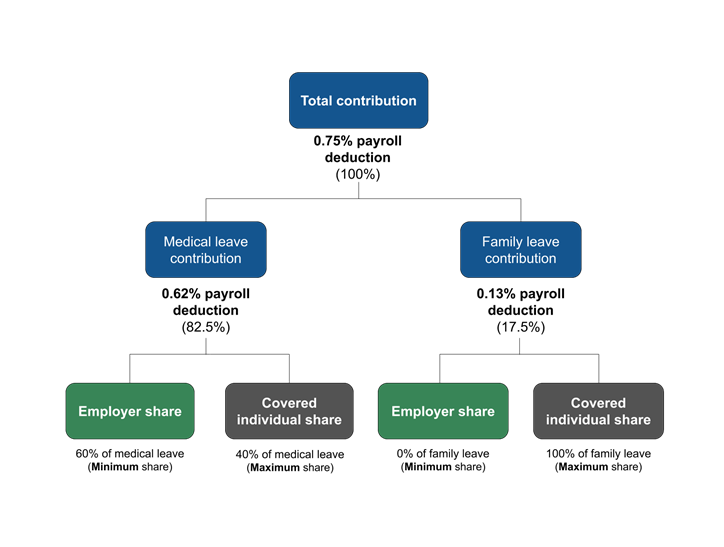

On October 1, 2019, employers must begin withholding PFML contributions. For employers with 25 or more covered individuals the 0.75% tax contribution split between employee and employer as follows:

Employers with 25 or More Covered Individuals

Employers with 25 or more covered employees are responsible for at least 60% of the contribution for covered individuals’ medical leave. However, up to 100% of the family leave contribution can be deducted from the individual’s wages. These employers must provide direct notice to their 25+ employees setting out the above contribution rates. Additionally, said employers may be required to notify their independent contractors.

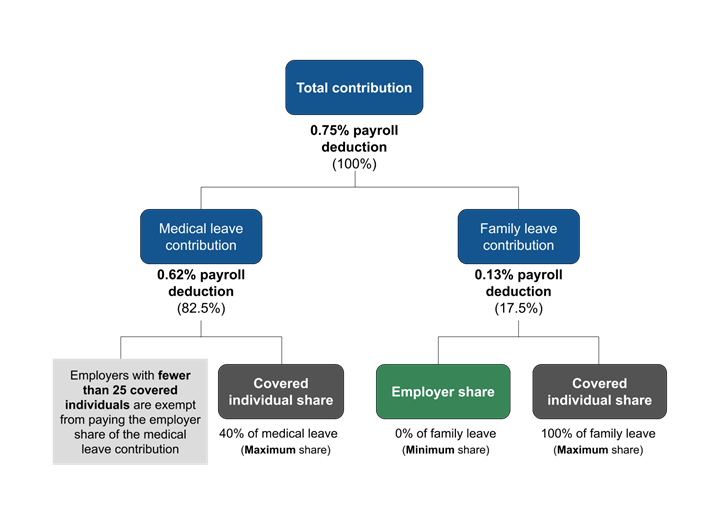

Employers with fewer than 25 covered employees are not required to contribute to either the medical or family leave contribution. Smaller employers must provide direct notice to their employees, and in some cases independent contractors, setting out the below contribution rates:

Employers with Fewer than 25 Covered Individuals

The Internal Revenue Service (IRS) has yet to issue guidance on the proper pre- or post-tax treatment of employee contributions. Follow the Department of Family and Medical Leave for the most up-to-date determinations and consult with your tax advisor on this issue.

Employers who want to self-insure or purchase a compliant insurance plan may file for an exemption from PFML until December 20, 2019 to avoid the first quarter of required contributions. However, employers seeking an exemption must continue to make deductions until the exemption is granted. First quarter contributions must be remitted through the Department of Revenue’s MassTaxConnect by January 31, 2020.

Have a question regarding PFML or other employment issues? David Robinson coordinates Ruberto, Israel & Weiner’s Employment Practice Group and is a member of the Litigation Practice Group. He can be reached at dwr@riw.com, 617-570-3562, or on Twitter at @DWRobinsonesq.